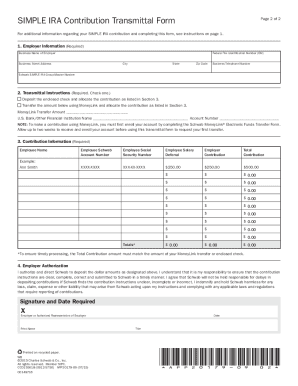

Charles Schwab APP30709SI 2004-2024 free printable template

Show details

Quit Help Clear Fields Save Form Print Contribution Transmittal Form Employer Instructions Use this form when making contributions to participant--including business owner--accounts. To allow for

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your charles schwab simple ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charles schwab simple ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charles schwab simple ira contribution transmittal form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit schwab simple ira contribution transmittal form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out charles schwab simple ira

How to fill out Charles Schwab Simple IRA:

01

Open an account: To start, visit the Charles Schwab website and click on the "Open an Account" button. Follow the instructions provided to fill out the necessary information, such as your personal details, employment information, and contribution amount.

02

Choose your investments: Once your account is open, you'll need to select your investments. Charles Schwab offers a wide range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Consider your investment goals and risk tolerance to make informed decisions.

03

Set up automatic contributions: It's recommended to set up automatic contributions to your Simple IRA. You can choose the frequency and amount you wish to contribute, whether it's a fixed dollar amount or a percentage of your income. This will help ensure consistent savings for your retirement.

04

Complete beneficiary designation: Designate beneficiaries for your Simple IRA by providing their names, contact information, and their relationship to you. This step ensures that your assets will be transferred to the designated individuals in case of your passing.

05

Review and manage your account: Regularly monitor your Charles Schwab Simple IRA account to track its performance and make any necessary adjustments. Consider consulting with a financial advisor to ensure your investment strategy aligns with your retirement goals.

Who needs Charles Schwab Simple IRA:

01

Employees without a retirement plan: Individuals who do not have access to an employer-sponsored retirement plan can benefit from opening a Charles Schwab Simple IRA. It provides a tax-advantaged way to save for retirement.

02

Small business owners: The Charles Schwab Simple IRA is also suitable for small business owners who want to offer a retirement savings option to their employees. It is comparatively easy to establish and manage, with minimal administrative responsibilities.

03

Self-employed individuals: If you are self-employed or a freelancer, you can contribute to a Charles Schwab Simple IRA on your own. This allows you to save for retirement while taking advantage of potential tax benefits.

Overall, the Charles Schwab Simple IRA is a flexible retirement savings account that can be beneficial for employees without access to a retirement plan, small business owners, and self-employed individuals looking to save for their future.

Video instructions and help with filling out and completing charles schwab simple ira contribution transmittal form

Instructions and Help about schwab form contributions

Fill rate tax : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is charles schwab simple ira?

Charles Schwab Simple IRA is a retirement savings plan that allows individuals to save for retirement on a tax-deferred basis. It is designed for businesses with 100 or fewer employees who are either self-employed or do not have access to an employer-sponsored retirement plan. With a Charles Schwab Simple IRA, employees can contribute up to $13,500 in 2021 and $14,000 in 2022. Employers can also make contributions to their employees’ accounts.

What information must be reported on charles schwab simple ira?

Charles Schwab Simple IRA requires employers to report the following information to their employees, the Internal Revenue Service (IRS), and the Department of Labor:

1. The total number of eligible employees

2. The total contributions made by each eligible employee

3. The total employer contributions

4. The total value of each employee's account

5. The rate of return on each employee's account

6. The date when each employee's contributions were made and/or withdrawn

7. The date when each employer contribution was made

8. A record of all distributions made from the account

9. The total amount of all distributions

10. The total amount of taxes and other deductions taken out of the account

11. The date when the plan was established

12. The name and contact information of the plan's administrator

When is the deadline to file charles schwab simple ira in 2023?

The deadline to file a Charles Schwab Simple IRA in 2023 is April 15th, 2024.

What is the penalty for the late filing of charles schwab simple ira?

The penalty for a late filing of a Charles Schwab Simple IRA is a 6% excise tax of the amount not timely deposited.

Who is required to file charles schwab simple ira?

The individuals who are required to file a Charles Schwab SIMPLE IRA (Savings Incentive Match Plan for Employees) are the employees who are eligible to participate in the plan. These employees typically work for small businesses that have chosen to offer a SIMPLE IRA as a retirement savings option for their employees.

How to fill out charles schwab simple ira?

To fill out a Charles Schwab Simple IRA, you will typically need to follow these steps:

1. Gather required information: Collect all the necessary documents and information you will need to fill out the application, such as your Social Security number, contact information, employment details, and beneficiary information.

2. Access the Charles Schwab website: Go to the Charles Schwab website (www.schwab.com) and navigate to the Simple IRA section. Click on the "Open an Account" or "Apply" button to start the process.

3. Choose your account type: Select the Simple IRA account option from the available choices.

4. Provide personal information: Fill in your personal details, including your name, date of birth, Social Security number, email address, and phone number.

5. Employment information: Provide your current employer's information, including the company name, address, and phone number.

6. Contribution details: Specify your desired contribution amount and frequency, such as the percentage or dollar amount you want to contribute to your Simple IRA and whether you plan to make regular or one-time contributions.

7. Beneficiary designation: Indicate the individuals who will receive the proceeds of your Simple IRA in the event of your death. You will need to provide their full names, relationship to you, and their Social Security numbers or dates of birth.

8. Submit the application: Review the information you have provided, make any necessary corrections, and then submit the filled-out application. You may need to e-sign the application or print and mail it to Charles Schwab depending on their specific requirements.

9. Fund your account: Once your application is processed and approved, you will need to fund your Simple IRA by depositing money into the account. You can choose to contribute through direct deposit, transfer from another retirement account, or by writing a check.

It's essential to note that the process may vary slightly depending on your specific circumstances and any additional requirements imposed by Charles Schwab. It is always a good idea to consult the Charles Schwab website or reach out to their customer service for any specific questions or concerns you may have.

What is the purpose of charles schwab simple ira?

The purpose of the Charles Schwab Simple IRA (Individual Retirement Account) is to provide a retirement savings option for small businesses and self-employed individuals. The Simple IRA allows eligible employees to contribute a portion of their salary on a pretax basis, and employers are required to make either matching contributions or non-elective contributions. This retirement plan is designed to be easy to administer and has lower administrative costs compared to other retirement plans, making it attractive for small businesses. Overall, the purpose of the Charles Schwab Simple IRA is to help individuals and small businesses save for retirement in a tax-advantaged manner.

How can I manage my charles schwab simple ira contribution transmittal form directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your schwab simple ira contribution transmittal form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit schwab contribution transmittal form online?

The editing procedure is simple with pdfFiller. Open your simple ira contribution worksheet in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete charles schwab contribution transmittal form on an Android device?

Use the pdfFiller app for Android to finish your charles schwab simple ira transmittal form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your charles schwab simple ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schwab Contribution Transmittal Form is not the form you're looking for?Search for another form here.

Keywords relevant to simple ira contribution transmittal form

Related to charles schwab transmital form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.